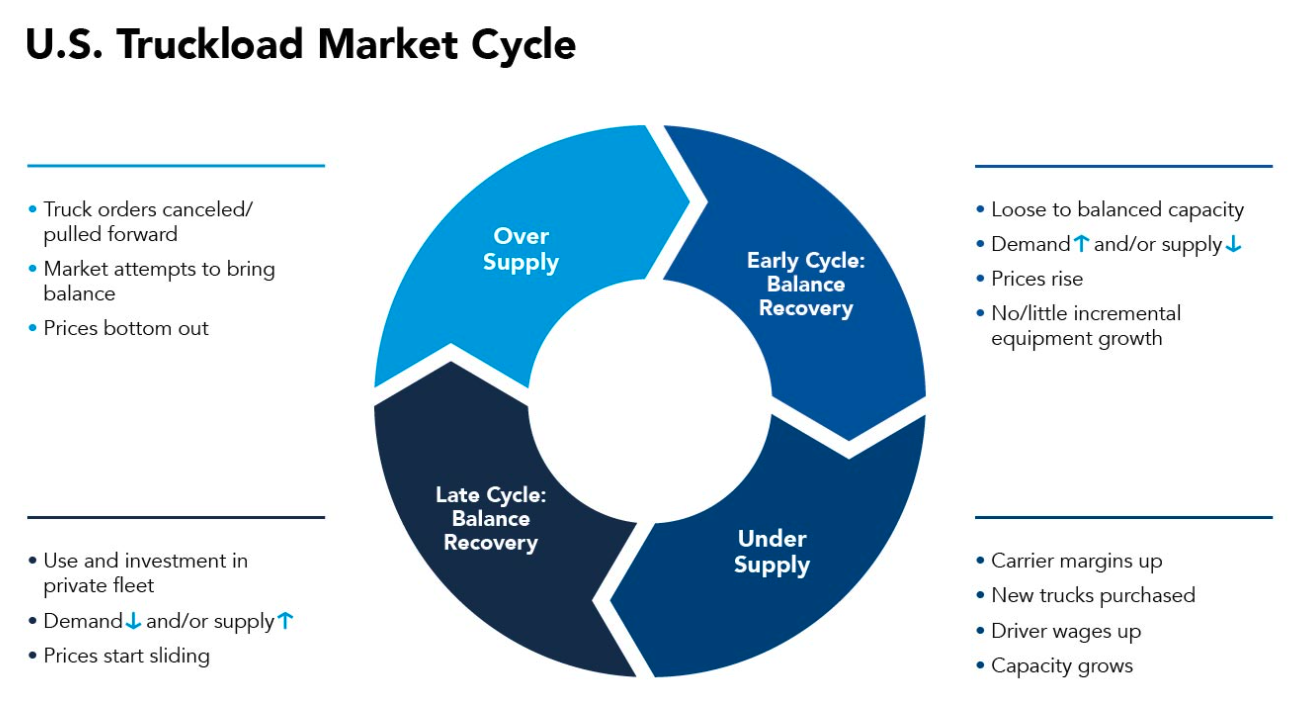

The historical truckload cycle offers valuable insights into today's truckload market and helps us anticipate what's ahead as we analyze the balance between freight demand and supply. The U.S. truckload sector follows a recurring pattern over time, reflecting the ebb and flow of supply and demand. Our colleagues at C.H. Robinson have taken our breakdown of this cycle and created an informative graphic that clearly outlines each phase of the process. Understanding the truckload cycle is essential for making informed decisions in the freight industry. By combining this knowledge with ACT's Class 8 tractor data, you can better predict where we are in the cycle and how to prepare for the next stage. Early Cycle: Demand Recovery and Capacity Tightening. The cycle typically starts in a relaxed or balanced market. As freight demand begins to recover, capacity tightens, leading to driver shortages. This shift in power favors carriers, who push rates up first through the spot market, and then in contracts about six months later. During this phase, Class 8 tractor production tends to be low, while the load-to-truck ratio and spot rates rise, along with growing Class 8 orders. Mid-Late Cycle: Shippers Take Action. As shipping costs increase, shippers look for ways to cut expenses by improving efficiency and shifting freight to private fleets. At the same time, the cycle has been running for some time, and for-hire freight growth begins to slow or even reverse. This creates a supply-demand imbalance, pushing truckload rates down and hurting carrier profitability. As a result, order rates decline, and cancellations increase. Late Cycle: Adjusting to Lower Profitability. In the final stage, the driver shortage issue becomes less prominent, though it never fully disappears. Carriers respond by cutting equipment budgets and canceling orders, which slows down the rate of new truck acquisitions. This gradual reduction in supply helps restore balance with demand, setting the stage for the cycle to begin anew.

Our Small Excavators are very popular in the rural market due to their low price, light weight, convenient maintenance and repair, flexible operation, wide use and high efficiency!

Main including 1.6tons smaller excavator ,1.0tons smaller excavator ,2.0tons ,1.0tons and other different type of excavators.

They all will work smoothly with smaller road roller ,smaller Wheel Loaders etc .

Welcome your inquiry !

Smaller Excavators,Mini Excavator New Kubota,1.6Tons Smaller Excavators,Different Type Of Excavators Shandong Ocean Machinery Com.LTD , https://www.sdoceanmachine.com

Mid-Cycle: Fleet Expansion and Capacity Growth. With higher rates and improved margins, fleets are able to attract more drivers by offering better pay. As profits improve, operators invest in new trucks and trailers, driving up industry production. Due to the highly fragmented nature of the sector, many fleets make similar expansion decisions around the same time, often resulting in excess capacity. This phase is marked by high Class 8 tractor build rates and long order backlogs.

June 29, 2025